“…The ETS includes more than 80 per cent of the world’s carbon credits, each of which represents the right to emit one tonne of carbon into the atmosphere. Each country in the EU has set a total limit on emissions and then allocated allowances to large carbon emitters, such as energy companies…”

“…They can also use Certified Emission Reductions, credits brought into the system from outside based on projects cutting carbon emitted elsewhere. The CERs are approved by the United Nations under the Kyoto protocol, but at this point, they may only make up a small proportion of an EU company’s emission allowance….”

http://www.ft.com/cms/s/0/2f0ea55c-aec9-11dd-b621-000077b07658.html?nclick_check=1

ETF Securities, which has led the way in providing innovative exchange traded commodity products, has just launched a carbon ETC, providing easy access to the world’s largest carbon trading market, the European Union Emissions Trading System.

The ETS includes more than 80 per cent of the world’s carbon credits, each of which represents the right to emit one tonne of carbon into the atmosphere. Each country in the EU has set a total limit on emissions and then allocated allowances to large carbon emitters, such as energy companies.

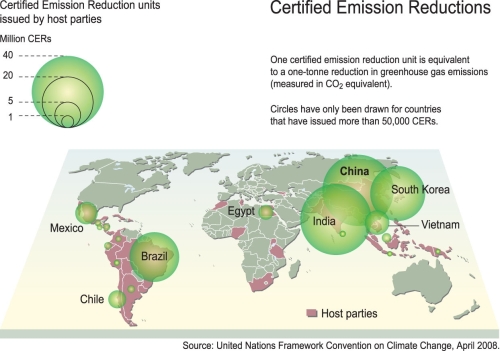

The companies are then free to trade these allowances (EUAs) with each other to allocate them as efficiently as possible. They can also use Certified Emission Reductions, credits brought into the system from outside based on projects cutting carbon emitted elsewhere. The CERs are approved by the United Nations under the Kyoto protocol, but at this point, they may only make up a small proportion of an EU company’s emission allowance.

There are several opportunities for investors in this process. They can take a view on the price of carbon units, which have recently fallen from their July 1 peak of €29.33 to a low on October 28 of €17.40. ETF Securities is bullish on this: “Long term global growth in terms of structural demand led by energy markets should give a floor to the markets,” says Daniel Wills, a senior ETF Securities analyst.

Other commentators, however, are not so optimistic. Alessandro Vitelli, director of strategy and intelligence at carbon finance consultant Ideacarbon, points out that shrinking industrial output across Europe will lead to shrinking demand for emission allowances.

“Industrial companies are busy selling off any surplus EUAs in order to raise short-term cash,” says Mr Vitelli. “These surplus EUAs are being snapped up by European utilities, which face a far greater shortfall of allowances than their industrial counterparts.”

Another limiting factor is the relative cost of oil, which is a cleaner fuel than coal. As long as the price of oil remains low enough, industry will continue to burn it in place of coal, lowering the demand for emission allowances.

“Passive exposure is probably a risky game at the moment, with the price of oil so low,” says Danyelle Guyat, a senior principal on the responsible investment team at consultant Mercers. “The alpha strategies, on the other hand, where they try to exploit the arbitrage opportunities, could be very interesting.”

This is precisely what Simon Glossop, chief executive of CF Partners is hoping to do with the newly launched CF Carbon Fund.

“Our fund is very different from the others, because it’s a carbon trading hedge fund,” says Mr Glossop. The trading strategies used include volatility, arbitrage, where units are mis-priced perhaps due to illiquidities in the market, betting on the future price of units, and several others.

Increased volatility is a bonus for the CF Carbon Fund, therefore, and in theory at least, a lower price should not present a problem for the fund. Mr Glossop is nevertheless optimistic about the future price of carbon: “Up to Christmas, the price will probably stay in a range close to these current levels, but leading up to 2012 we will see significant prices rises from here.”

The date is relevant because that is when the current phase of EU allowances ends and the limits are reset. In the initial trial phase, from 2005 to 2007, the limits were set too high, not constraining emitters at all, so the price collapsed. This brought the nascent system into general disrepute, but specialists in the market are more prepared to cut the administrators some slack.

“They’ve done a pretty good job of putting a system into place in a relatively short space of time,” says Mr Glossop, and indeed the global carbon market, now worth $100bn (£63bn, €78bn), grew by 56 per cent from 2007 to this year.

As well as the ETS, this includes CERs, the credits created when a project takes carbon out of the system, perhaps by planting trees or building a wind farm.

A number of investment companies specialise in supporting these projects, which are usually in developing countries. In return for helping them find financing and deal with the bureaucracy of UN certification, the investment company can then buy the carbon credit to resell into the developed world.

As an asset class, carbon is too young for any very precise conclusions to be drawn about it. So far, it looks relatively uncorrelated with mainstream asset classes, although it has recently been drawn into the global market weakness, and it does hit the fashionable environmental nail squarely on the head.

However, since its very existence depends on the political will to limit greenhouse gases, and both supply and demand depend largely on government policy, its risk profile is uniquely related to politics.

Leave a comment